READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

By Syed Zaidi, Principal aviation analyst, ISTAT certified appraiser, ASA senior appraiser at Ascend by Cirium

The third and fourth quarters of 2022 saw preowned market inventory increase steadily, causing some industry stakeholders to predict a possible softening in pricing, but this did not materialize. On the contrary, closed transactions through the end of the year continued to demonstrate increased prices, ending another strong year for values.

New deliveries in 2022 numbered just over 700, much like 2021, constrained by supply chain issues that all manufacturers continued to face through the year. This has also been a contributing factor to limited preowned inventory on the market, especially for younger aircraft which showed considerable increases. The “buyer distress” scenario, where buyers were willing to pay higher prices (sometimes even entering bidding wars and paying above asking price) motivated by previously lost deals continued to dominate much of the year. Many popular variants such as Embraer’s Phenom 300 and Cessna’s CJ4 saw Market Values increase to levels above manufacturer delivery pricing, as backlogs and delivery timelines continued to expand throughout the year.

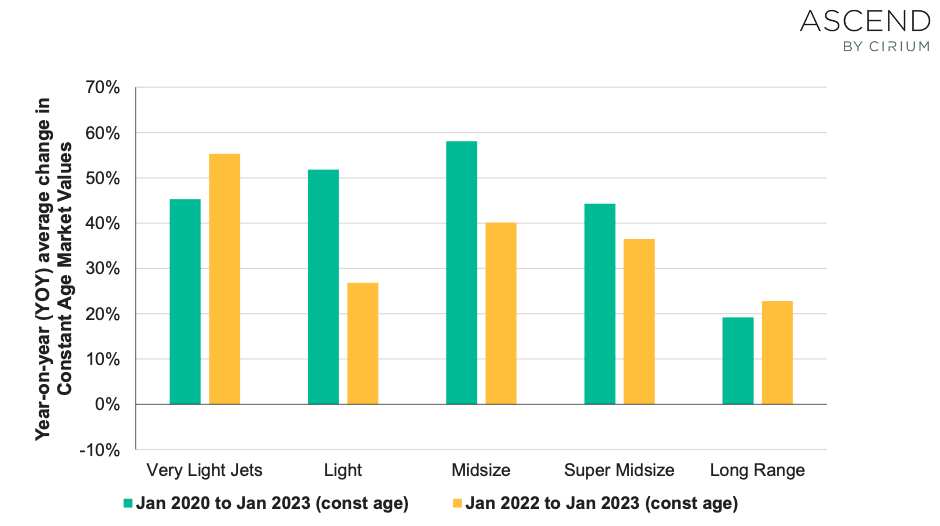

While increases in constant age values across all size segments were under 30% year on year in 2021 compared to 2020, these percentage increases grew significantly in 2022, as demonstrated by the yellow bars on the chart below. Compared to pre-pandemic numbers, Market Values are now nearly 60% higher on midsize aircraft, around 50% higher on light jets, and around 45% higher on both very light jets and super-midsize aircraft on a constant age basis (meaning, comparing the same age of aircraft over time). Although the long-range sector saw fleet weighted average values increase just over 20% year on year going into 2023, the overall increase compared to pre-pandemic numbers is still less than 20% on a constant age basis and is more manageable in terms of residual value risk.

The larger percentage increases on the small (very light, light and midsize) segment can be attributed to large percentage increases over lower dollar value assets with large fleets. However, the super-midsize sector has historically been more susceptible to market corrections due to the high concentration of shared use (charter/fractional) fleets in that size segment. We continue to monitor this sector closely, as recent declines in charter flight activity can be a leading indicator for demand for business jet travel starting to slow down.

Market Values being over 40% up on pre-pandemic levels, therefore, represent real risk to owners, financiers and investors should shared use operators move to lean their fleets and drive a market correction.

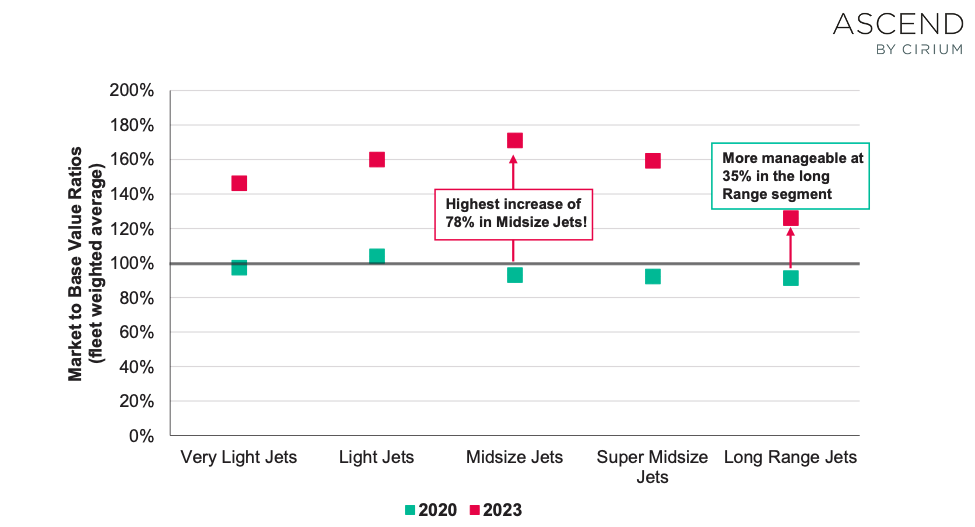

Market Values have now undoubtedly entered “bubble” territory, adding to the various other challenges that lenders have already been facing, including staying competitive against non-traditional business jet financiers, higher interest rates, exposure to uncertainty in value depreciation for overpriced assets and dealing with first time business jet buyers. Market-to-Base Value ratios, which Ascend by Cirium uses as a measure of potential downside risk by comparing the current Market Value against Base Value, are now significantly above 100% across most size segments. Base Value is defined as the long-term underlying economic value opinion of the asset in a stable market environment, assuming supply and demand are in equilibrium. For business aviation, that might assume 5-10% availability for sale.

In January 2020 (shown by the green markers), this metric averaged around 95%, which indicates a market where supply (both preowned and new deliveries) was slightly above demand from customers. There were some pockets of inventory in certain markets, mainly the midsize, super-midsize and long-range sectors, which kept the ratio below 100% for those sectors. Today this Market-to-Base Value ratio (shown by the red markers) is averaging 145%, with all segments remaining in limited supply since late 2020. Improvements in Market Values and reductions in preowned inventory were certainly a welcome change in the last couple of years, effectively reversing a decade of oversupply since the global financial crisis. However, a look at the data indicates that in January 2008 before the financial crisis, Market-to-Base Value ratios across size segments were approximately 108-120%. In January 2010, the same ratios ranged between 64-88%. While the declines were of a lower magnitude on long-range aircraft, the smaller segments saw larger reductions.

This analysis is a clear indication of an overheated market, and it points to very real downside risk on the horizon.

We are however, in a very different market today than we were in 2008, with a lot less speculative buying and more established fleet operators. The midsize sector has shrunk considerably in competing types, which means much of the fleet is older in age and is therefore showing larger percentage increases relative to lower underlying Market Values. The long-range sector, which represents the highest value assets and hosts majority of the new types in development, has seen more manageable increases and therefore presents lower downside potential when the market demand and supply dynamic starts to correct itself. With commercial airline schedules returning to pre-pandemic frequencies, now begins the test of the true resilience of the new users of business aviation.

SEE MORE ASCEND BY CIRIUM POSTS.

LEARN MORE ABOUT CIRIUM FLEETS ANALYZER and Cirium Values Analyzer.