READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS.

MEET THE ASCEND BY CIRIUM TEAM

By Scott Zhao, Aviation Analyst at Ascend by Cirium

Generation changes in the P2F market too?

Over the past two years, demand for passenger-to-freighter (P2F) conversions has surged, with over 500 orders announced, resulting in a growing number of aircraft engineering providers entering the market across the world and an expansion of aircraft types undergoing conversion. In 2020, EFW converted the first A321 freighter and it is already in commercial operation, in 2021, it began to convert the first A320 freighter which will be used for a series of flight tests to gain a supplemental type certificate from EASA this year.

During the same period, Boeing revealed a long list of plans for its expansion in conversion facilities and dedicated lines including a new facility in Costa Rica, and two lines at Taikoo Aircraft Engineering’s facility in China, both for 737-800s. Others including GAMECO, KF Aerospace and Boeing’s Gatwick MRO facility. The list goes on even longer as other companies also have plans to expand their conversion capabilities such as IAI’s first 777-300ERSF conversion.

The speed in which P2F investors are investing in the newer generation types is probably also faster than some might have expected, evidenced by frequent announcements of conversion orders in the market. Avolon’s 30 A330-300 order with IAI, BBAM’s 20 A320/A321 order with EFW, and AerCap/GECAS’s current holding of more than a hundred orders and options for 737-800BCFs and 777-300ERSFs are among such examples.

These events lead to a sign that the P2F market is pivoting around a generational shift from the older types like the 737 Classic, 757 and 767 to newer types like the 737NG, A321 and A330.

This then leads to the question: have these old types really come close to an end of their conversion careers?

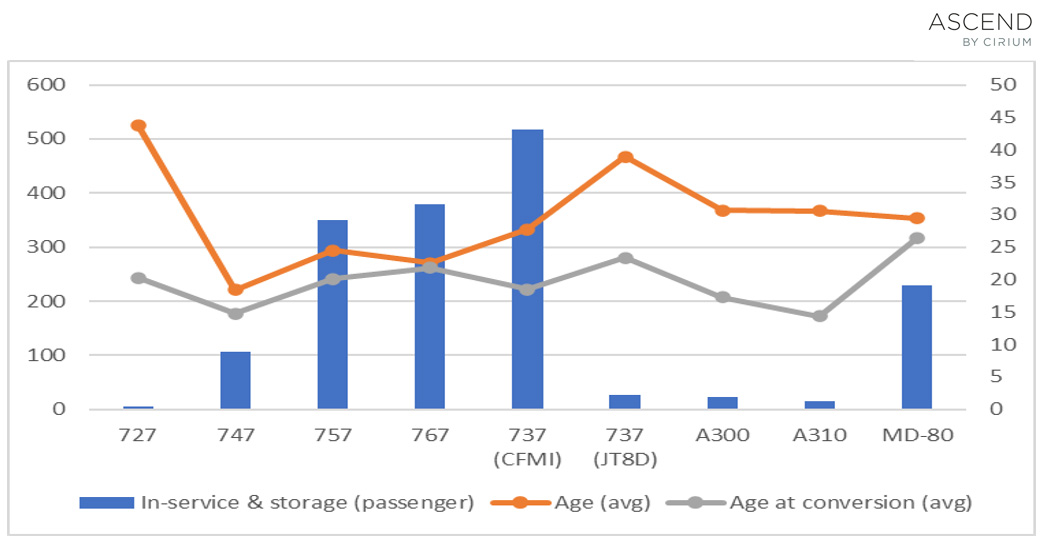

The below chart is a snapshot of the older types that are currently still in passenger services around the world, which also have been serving well in the P2F sector in the past several decades. The grey line shows the “average age at conversion” for those which have been converted.

According to Cirium Fleets Analyzer data, the average age at conversion in the past for 737 Classics, 757 and 767 for example, sit within the range of 19-22 years. Although each type still has a few hundred left running in passenger service, more than 75% of these aircraft are above 22 years old which potentially reduces the economics of converting them. In addition, there is also a portion of these aircraft currently running passenger services in less developed countries or politically unstable countries like Congo and Iran. For these aircraft, for anyone to invest in converting them would pose operational and economical challenges. Therefore, it can be concluded that feedstock availability of older types is indeed gradually drying up in the market, in fact, some conversion lines for older types like the A300 have ended already.

For those who are still looking at converting older types in future years, it’s probably worth thinking twice on the economics of such investment and evaluate carefully on whether your investment is real demand based or just for speculative investment. On the other hand, while so many are rushing into P2F for the newer types, is there a chance we may end up with a supply glut once passenger belly capacity comes back online?