READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

Thomas Kaplan, Senior valuations consultant, ISTAT certified senior appraiser AT ASCEND BY CIRIUM

News of the expected acquisition of Standard Chartered’s aircraft leasing business has been stoking talk of a consolidation trend in the aircraft leasing market. However, the expected buyer is a new entrant: Saudia Arabia’s AviLease. Is the consolidation outpacing the new entrants?

During the Pandemic, there have been some high-profile lessor consolidations including the two largest lessors in the world: AerCap and GECAS. Other acquisitions included SMBC Aviation Capital and Goshawk, Carlyle Aviation Partners and AMCK, with each being large enough to be considered in the top 20 by fleet size pre-merger. There have also been smaller consolidations, such as Stratos acquiring Magi Partners. Macquarie AirFinance is set to acquire the majority of the ALAFCO Fleet, though ALAFCO will remain a lessor after closing.

Cirium Fleets Analyzer data shows that at the end of 2019, there were 176 lessors with at least one commercial narrowbody or widebody jet aircraft in-service or parked. Today, that number has actually increased to 184 lessors. So the number of new entrants is actually outpacing the consolidation. Notable new entrants which managed to grow their fleet to over 30 during this time include US-based lessors Griffin Global Asset Management, Vmo Aircraft Leasing and SKY Leasing. Abu Dhabi based Sirius Aviation Capital has grown to 18 commercial narrowbodies, but the Middle Eastern start-up making the most news is of course AviLease whose current portfolio of seven aircraft acquired through purchase and leaseback from FlyNas is soon to be bolstered by a 13-aircraft portfolio from Avolon, 25 more PLBs from FlyNas and Saudi Arabia and potentially an additional ~100 if it acquires Standard Chartered.

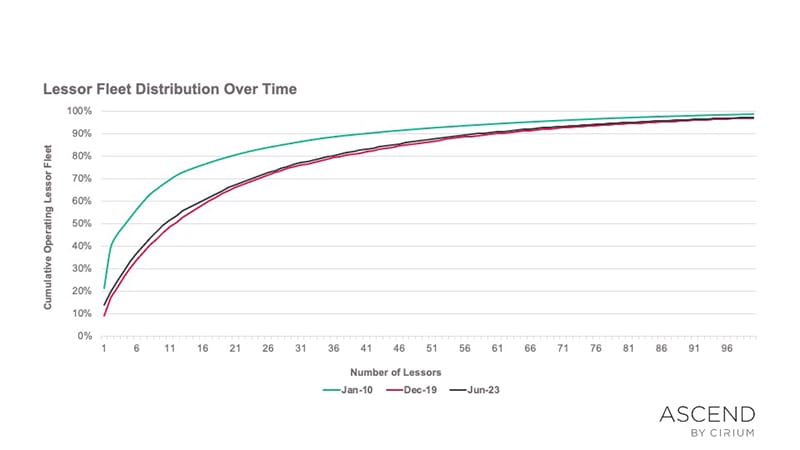

The below chart shows how the lessor landscape has evolved since the beginning of the last decade.

In the 2010s the number of lessors grew from 141 to 176 and the leased fleet became far more fragmented. While 80% of the leased fleet was held by only 21 lessors in 2010, by the end of the decade this nearly doubled to 38 lessors.

This decade, which started with the pandemic, so far has seen a reversal of this trend for the largest players. The 80% of the fleet is now held by 36 lessors, and the top five lessors have increased their share to 33% from 30%.

While new entrants have continued to join the aircraft leasing business despite the hard times wrought by the pandemic (or because of them), when it comes to the largest lessors who control most of the fleet, consolidation is leading the way by a close margin.

LEARN MORE ABOUT CIRIUM FLEETS ANALYZER – SEE MORE ASCEND BY CIRIUM POSTS.