READ ALL OF THE LATEST UPDATES FROM ASCEND BY CIRIUM EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND BY CIRIUM TEAM.

Offshore – Reasons to be cheerful

By Sara Dhariwal, Senior Aviation Analyst at Ascend by Cirium

The indicators at the start of 2022 pointed towards an offshore aviation market with a good opportunity of stabilizing with high oil prices and continued consolidation. However, surplus was still notable, mostly for types with a high proportion of the fleet exposed to the volatile oil & gas sector.

Over the years, we renamed the term “green shoots” in the offshore industry to “seaweed” as there were some sightings of an improving market, but it was largely under the surface with an uncertain outlook. However, one of the greatest advantages of certain types of seaweed, is that they can grow astonishingly fast under certain conditions.

As the world emerged from the COVID-19 pandemic and sanctions on Russia became increasingly tight following its offensive in Ukraine, the world soon kicked into action to start securing energy supplies. By quarter three 2022, values for both the challenged Sikorsky S-92A and Leonardo’s AW139 saw improvements as surplus capacity was deployed into the industry following the strengthening in demand.

It was the first time since the oil & gas downturn began that values for helicopters with large exposure to the sector improved.

The current demand indicators for the oil & gas sectors are indeed likely reasons to be cheerful after a seven-year slump.

Of course, recovery is often not a smooth process and there are many market forces at play, including economic burdens through inflationary pressures, an outlook of a slowdown in economic growth, as well as challenges around the supply chain and MRO capacity.

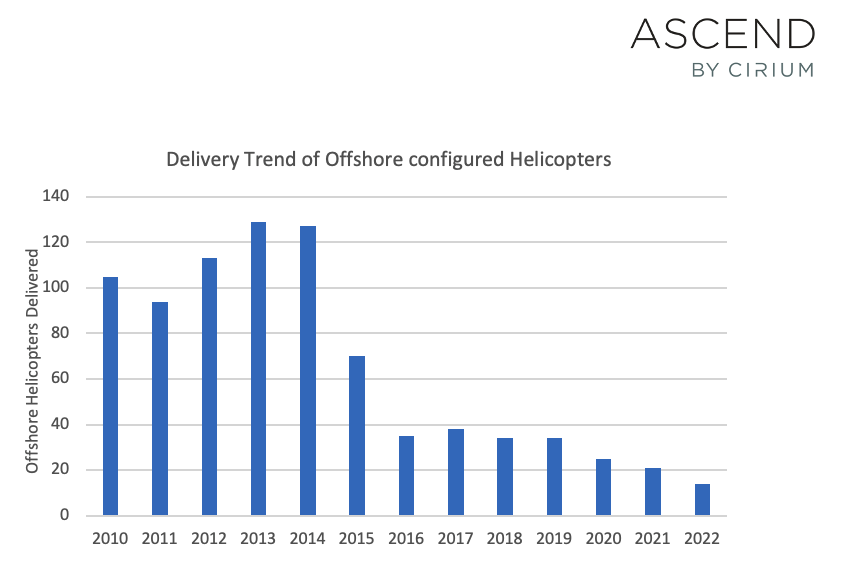

As one would expect following the downturn since 2016, new deliveries to the offshore space have reduced significantly. Cirium Fleets Analyzer data shows an average of just over 100 delivered helicopters per year between 2010-2015, reduced to just under 30 in the following five years between 2016-2021. In 2022 there were 14 recorded, although this may change as the OEMs have not yet released their official figures. To justify an investment in a new order, one must be reasonably certain of continued demand and that the economics pertaining today will still balance out a future investment.

The Ascend by Cirium 2022 Helicopter Fleet Forecast predict the industry will continue to see low levels of deliveries for the immediate future with a focus on replacement of around 20% of the current fleet.

In terms of predicting future demand, it is challenging as the industry is continuing to develop. There is an emphasis to reduce the reliance of fossil fuels, as well as the emergence of new technology. In the case of the latter, this is not just referring to emerging modes of transport but also to increasing efficiency in the operation of oil rigs with fewer personnel required.

A review of historical data shows that at the height of the upturn, there was ratio of around 0.55 helicopters to any one oil rig and at that time, capacity far outweigh supply. At the bottom of the slump, the ratio increased to 1.1 helicopters to any one rig, which created excess supply and an unfavorable supply/demand balance which put significant pressure on values.

Today, the data available shows a ratio of 0.8 helicopters per rig. This data suggests that a level of excess of helicopters remains, especially when also considering the continuing modernization of rigs.

One of the key attributes of a helicopter from a financial perspective, is the asset’s strong residual value, or useful economic life, which Ascend by Cirium model on 30 years.

While declining deliveries may seem a bad omen, the OEM restraint over the past few years is commendable and supports the strong residual values of the asset class.

There is a clear argument for using existing fleet, rather than ordering new, to maintain the useful economic life and continuing to make investments highly attractive. Not to mention the environmental advantage in reusing, rather than buying new.

Airbus Helicopter’s recently announced acquisition of ZF Luftfahrttechnik may be a sign that the OEMs are considering expanding their position in the sector.

No doubt, the coming years will be defining for the future of the industry.

Elsewhere in the market

For other sectors such as emergency medical services (EMS) and search and rescue (SAR), values continued to remain largely stable throughout 2022.

At the smaller end of the corporate market, such as the Bell 505, Bell 407 and Leonardo AW109, values for used fleet started firming as demand increased soaking up any excess capacity, helped by the long lead times for new-build machines.

However, corporate helicopter usage in particular is highly sensitive to fluctuations in GDP growth and could be affected by a predicted slowdown in economic growth in 2023.

The parapublic sector is highly dependent on government spending. Large portions of such budget is largely expected to be diverted to defense in light of global instability and that could potentially have an impact on spending on both the EMS and SAR sectors.

It is unquestionably set to be another interesting year for the helicopter space and the Ascend by Cirium team will continue to liaise closely with the market and observe any movements that could impact values. Contact us for more information.

Read more Ascend by Cirium insights