READ ALL OF THE LATEST UPDATES FROM ASCEND CONSULTANCY EXPERTS WHO DELIVER POWERFUL ANALYSIS, COMMENTARIES AND PROJECTIONS TO AIRLINES, AIRCRAFT BUILD AND MAINTENANCE COMPANIES, FINANCIAL INSTITUTIONS, INSURERS AND NON-BANKING FINANCIERS. MEET THE ASCEND CONSULTANCY TEAM.

By Eric Tamang, Valuations analyst, Cirium Ascend Consultancy

The helicopter industry plays a crucial role in supporting various sectors such utility, corporate/VIP, offshore support and mission critical usages such as EMS and search and rescue (SAR).

Taking a closer look at the offshore space, the offshore helicopter industry is known to be cyclical, meaning that it experiences periods of growth and decline in line with the overall economic conditions and the demand for its services.

One of the main reasons behind this is linked to economic factor and oil price volatility.

During periods of sustained economic growth, there tends to be increased investment in offshore oil and gas projects, leading to higher demand for helicopter services.

Fluctuations in global oil prices also have a significant impact on the offshore helicopter industry. When oil prices are sustainably high, energy companies have more financial resources available for exploration and production activities, leading to increased demand for transportation services provided by helicopters. And again, conversely, when oil prices drop significantly or remain low for an extended period, energy companies may cut back on their operations and reduce their reliance on helicopters.

Based on Cirium Fleets Analyzer, as of October 2023, there are about 26,000 civil helicopters in service and storage globally. The fleet being considered below comprises all Western-built turbine helicopters, with operators taken to be civil or governmental – which will include parapublic operators. However, pure military operators are excluded, as are types from Russia or China.

Civil Helicopter Fleet Distribution by Usage

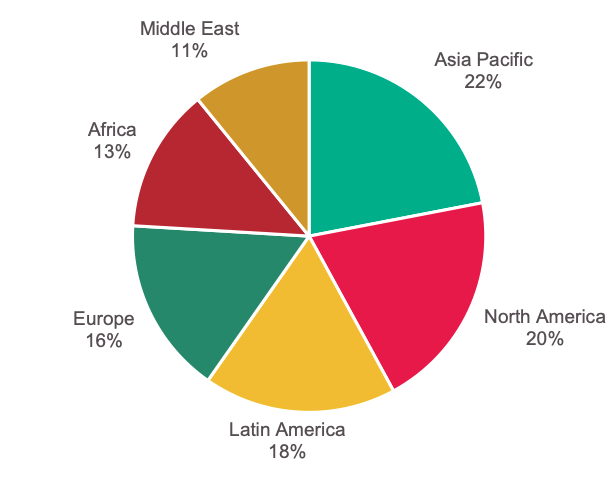

Looking particularly at the offshore sector, the largest share of the fleet are in Asia Pacific, followed closely by North America, Latin America and Europe.

Civil Helicopter Offshore Fleet Distribution by Region

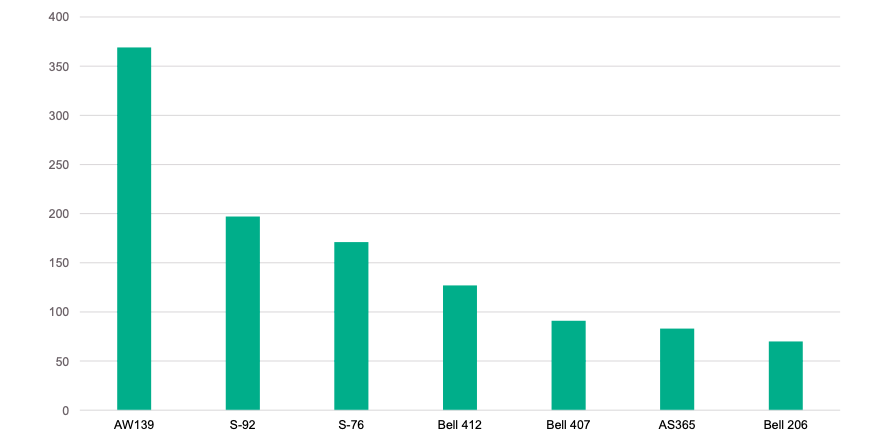

In terms of the offshore fleet distribution by type, the Leonardo AW139, Sikorsky S-92, Sikorsky S-76, Bell 412, Bell 407, AS365 and Bell 206 take the top 7 spots accounting for almost 70% of all helicopters in offshore usage.

Civil Helicopter Offshore Fleet Distribution by Type

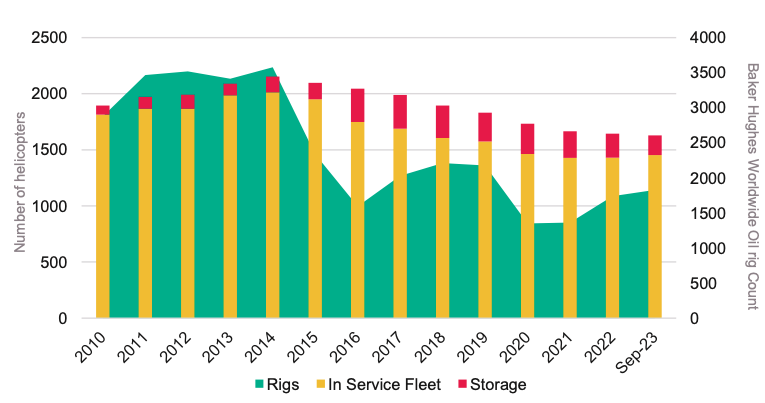

Looking at the Baker Hughes worldwide oil rig count against the number of helicopters in service and in storage shows that the oil and gas downturn between 2014-2016 quickly resulted in an over capacity scenario. The offshore sector has again got a boost and the supply/demand equilibrium is beginning to show some positive signs as countries safeguard their energy supplies as a result of the Russia/Ukraine conflict

Civil Helicopter Offshore Fleet against Worldwide Rig Count

Source: Baker Hughes Oil Rig Count, 23 October 2023

With this in mind, we have seen signs of improvement in the Current Market Values of the AW139 and S-92 this year, depending upon vintage. These changes were supported by a mix of transaction data, value opinion from the market as well as market activity and demand for each helicopter type.

Given the demand and supply outlook for the offshore market, will values continue to improve in 2024?

SEE MORE ASCEND CONSULTANCY POSTS. For more information, Contact us.