Prior to the COVID-19 pandemic, an airport could pitch a new route opportunity with market size and fare data in conjunction with economic links, destination attractions, and events like: major sports events, music festivals or large international conferences. However, the global travel downturn due to the pandemic, means airports are competing for their own survival. Understanding the dynamic nature of route and network planning has never been as important and aviation data is more critical than ever.

2020 a difficult year for air service development teams

Airports around the world faced a difficult challenge in analyzing demand as 2019 figures became impossible to use as a benchmark for future scenarios. US majors closed out 2020 with more than 900 aircraft in storage, representing some 27% of their combined fleet. American Airlines, Delta Air Lines, Southwest Airlines and United Airlines in December had a total of 921 aircraft in storage and 2,529 in service, Cirium fleets data shows. US carriers’ total capacity in December was down 45%, Cirium schedules shows. The rate of daily new cases of COVID-19 in the USA rose during the final four months of 2020 and have shown inconsistent signs of slowing down, making it unlikely that capacity would budge significantly during the initial months of 2021.

Traffic figures at an all-time low – January 2021 RPKs down 72.0% vs 2019

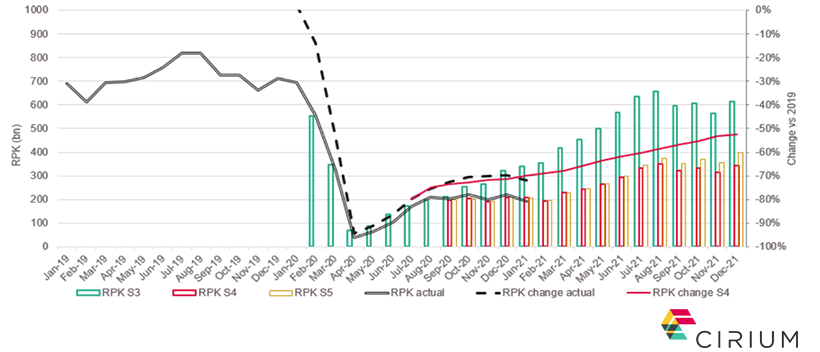

The Cirium team of expert consultants, Ascend by Cirium have plotted recovery scenarios based on a potential return of passengers – read more here about these scenarios. In this context, the chart below refers to Scenario 4 and shows traffic data from January 2021. The dashed line is the RPK change YoY and the red line is the Cirium recovery forecast. Despite the actual RPK change being slightly ahead in Q1, it is now falling behind the forecast for the first time in 2021. This is due to a combination of a reduction in travel for Chinese New Year and renewed lockdowns in Europe. Further uplift in traffic figures will all be reliant on a relaxation of international border restrictions. On a positive note, the US domestic market is seeing an uplift in figures. Cirium will continue to monitor these figures and clients of Cirium Diio, Cirium SRS Analyzer and FM Traffic can view the latest figures on a route-by-route basis.

New routes — a crystal ball dilemma

Air Service Development teams need to conduct thorough research on the market before planning any new route expansion. Monitoring RPKs and capacity figures as seen in this article will be critical in making intelligent decisions.

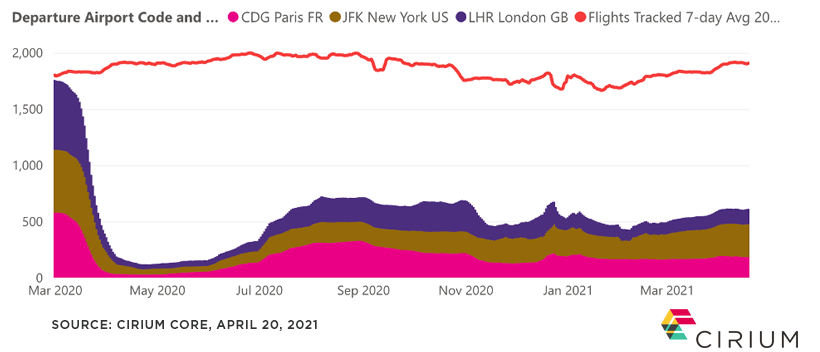

Large international hubs such as Paris Charles de Gaulle Airport, John F. Kennedy International Airport in New York or Heathrow Airport in London (level 3 slot-coordinated airports) were slot constrained before the pandemic. Due to the reduction in international travel these airports are operating at a much reduced capacity. When international restrictions are lifted it is not clear that popular routes in 2019 will bounce back to the same levels. Planning for a world that is 2019 2.0 is a high-risk strategy.

After analyzing Cirium schedule and traffic data, we estimate the rebound in travel will take several years. Therefore, airlines and airports should research thoroughly the merits of future routes and use aviation data to support those decisions.

New Cirium route forecast tool: Scenario Planner

Existing Cirium Diio, Cirium SRS Analyzer with FM Traffic customers can now subscribe to Cirium Scenario planner. A new add-on that helps Airports to propose new routes based on actual performance.

Users can:

- Stimulate the market with historical traffic and schedules data

- Adjust potential connection, and, arrival & departure times

- Analyze forecast outputs at the O&D level

Not a Cirium Schedules client? Cirium SRS Analyzer and Diio tools provide expert analysis on the global schedule. Find out more here and talk to a member of the team.