By Naomi Neoh, Air Transport Reporter Asia for Cirium Dashboard

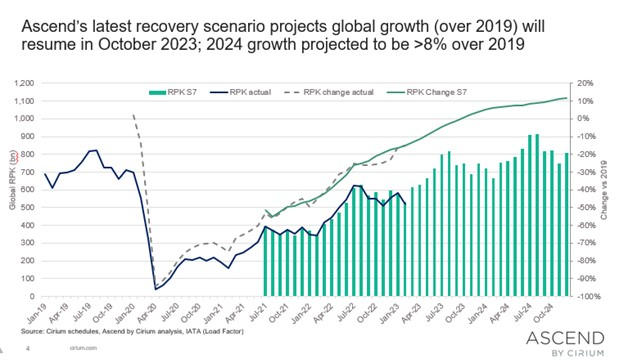

Global passenger traffic is recovering slightly ahead of earlier forecasts, with growth above pre-pandemic levels expected in October despite Asia-Pacific and China markets lagging other regions, Ascend by Cirium’s latest outlook shows.

Speaking last week at the ISTAT Asia conference in Bangkok, Ascend by Cirium global head of consultancy Rob Morris, Global head of consultancy at Ascend by Cirium, says that March data indicates that the return to growth of global traffic in RPK terms to 2019 levels could occur as soon as September.

This is based on the scenario that projects global traffic in 2023 to be on average 6% shy of 2019 levels, and 8% higher over the same in 2024.

“We’re well on track to recover, and then finally we can put our 2019 crutch back in the back in the cupboard, and we can look forward again to growth.”

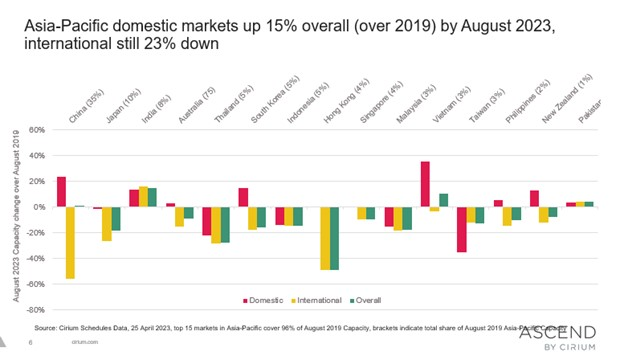

Asian markets, however, continue to lag behind other regions, having taken a longer timeline to ease border restrictions.

April schedules indicate that Asia intra-regional, transpacific, Europe-Asia, and domestic Indonesia are the only markets where capacity remained more than 15% below the same month in 2019, Morris observes.

“Intra-Asia [remains] significantly down because its reliance on China traffic,” he adds.

Nonetheless, the region’s outlook is improving, with August schedules data indicating that domestic markets will be up 15% on August 2019 levels, while international markets will trail that level by 23%.

The best performing domestic markets in the region are China and Vietnam, which are each up by about 20% and 40%, respectively, while India, Thailand and New Zealand are indicating growth of just under 20%.

Unsurprisingly, the worst performer in terms of international capacity was China, down on average 68%, followed by Hong Kong, at about 50% down.

China only reopened its borders in January, and carriers there have been slow to return international capacity compared to other jurisdictions.

Japan, Thailand, Malaysia, Australia and South Korea all clustered around the 20%-mark below 2019 levels.

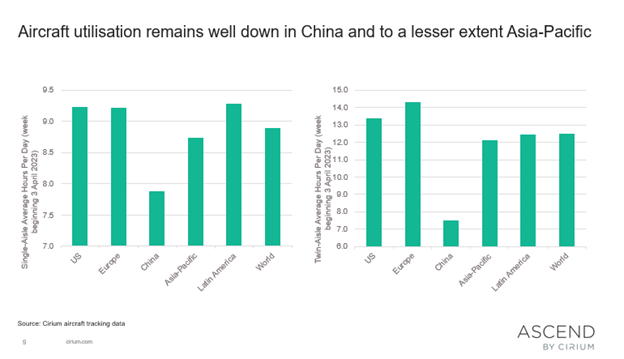

April aircraft utilization data also paints a similar picture, of the lag in recovery of China, and Asia-Pacific, to a lesser extent.

Narrowbodies in China are flying an average of less than eight hours, far behind the global average of just shy of nine hours, and even Asia-Pacific, which is above 8.5 hours.

The disparity is even more stark in terms of widebody utilization, with China averaging less than eight hours, versus the global average of above 12 hours and Europe, at above 14 hours.

This analysis was originally published in Cirium Dashboard. Get the view from above with Cirium Dashboard. Learn more.

Learn more about Cirium Tracked Utilization and Cirium Schedules.