In our first webinar of the year, Ascend by Cirium’s Rob Morris and George Dimitroff were joined by special guest speaker Dick Forsberg to discuss what 2023 holds for aircraft finance and leasing.

In a conversation moderated by Valuations Consultant Lalitya Dhavala, they shared their views on demand recovery in 2023, key developments in the operating leasing sector and evolving trends in aircraft values and lease rates, debating whether aircraft financiers, lessors, and manufacturers will keep their resolutions this year. Read on for our key takeaways from the live broadcast.

The Chinese market rebound may be slower than some expect

Rob Morris, Ascend by Cirium’s Global Head of Consultancy, began the webinar by presenting data on China, the market he termed “the final brick in the recovery wall”. The Chinese government’s pivot away from quarantine requirements for travelers at the end of 2022 has been a cause for optimism, with schedules and tracked utilization data showing cancellations falling and domestic flights close to 2019 levels.

However, Rob pointed to a slower pace of recovery than some would expect. “We were there in 2020 and 2021 with quarantine-free travel in other regions, and it has taken until the latter part of 2022 for those regions to recover”. International travel to and from China is predicted by some to return to 2019 levels by mid-2023, but Ascend’s projection for scheduled flights this summer is less bullish.

“Airlines are being extremely cautious in restoring capacity to China because there are a lot of things that need to happen before passenger confidence is fully restored” Rob explained. “China is coming back, but it’s coming back slowly”.

Dick Forsberg agreed with Rob’s assessment, pointing to capacity limitations exacerbated by the suddenness of the change. “Airlines have already put together a schedule for the next six or eight months and filed slot requirements in constrained airports” he explained.

“They are going to be scrambling to find the capacity to allocate onto routes in and out of China, and I think it will take until 2024 before all those international services are back up and running again.”

However quickly the Chinese market rebounds, it will be one to watch; it’s ability to offset the economic headwinds on a global level and continue the industry’s post-covid recovery will dictate the shape of the industry in 2024 and beyond.

There is more headroom for Value and Lease Rate recovery

Assessing the state of the passenger aircraft market, Ascend by Cirium’s Head of Valuations George Dimitroff compared Market to Base Value ratios for single-aisle and twin-aisle markets. On a fleet-weighted basis, single-aisles have returned to a positive ratio for the first time early 2020, when aircraft values were some 15% above their Base Values which represent a balanced market. The twin-aisle Market to Base Value ratio is rising, approaching one and indicating a values recovery after multiple base value impairments during the Covid pandemic.

What does this mean for the market? “For single-aisles we’re not necessarily back to 2019 levels, but we’re back to market equilibrium and trending towards a heated market, even if the market is not heated yet” George explained. “So arguably there is still upside for values of both wide- and narrow-bodies.”

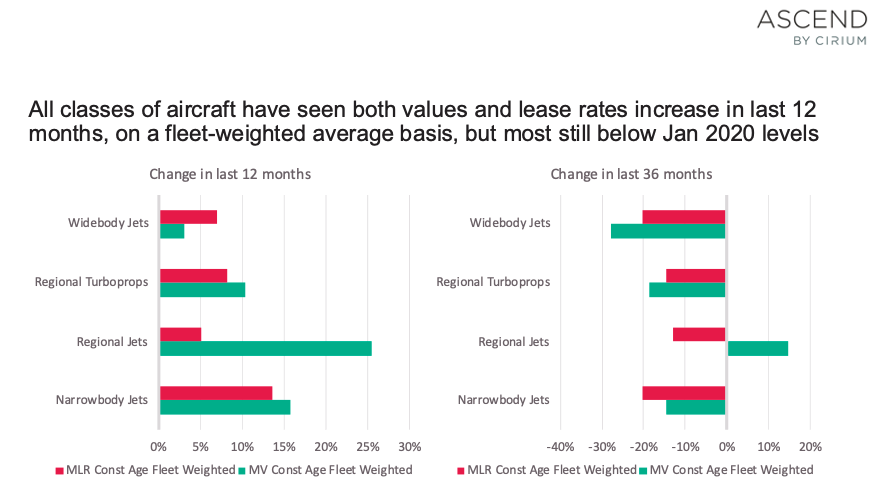

More broadly, both values and lease rates are on a sustained upward trend; data from Cirium Values Analyzer shows increases on a fleet-weighted basis across all classes over the last twelve months, although most have some way to recover to reach the January 2020 pre-covid benchmark. For some exceptions, notably freighter and new-build type, values are once again exceeding 2020 levels. With interest rates high and supply of new aircraft tight, lease rates on mid-life and younger aircraft have more upside potential than values.

Looking ahead, George pointed to a positive outlook for values and lease rates with headroom for further improvement, primarily driven by constrained supply.

“We’ve been producing new aircraft at a significantly lower level for nearly three years. This means we have held back a significant portion of supply from the market for quite a long time, and that is already helping values for newer aircraft and some used aircraft.”

He added that supply constraints will also help the lease rates recovery, due to manufacturers’ inability to reach pre-pandemic production levels in the face of continuing supply chain disruption.

China’s reopening is driving values and lease rates as well as demand recovery. “2023 is probably the year of continued twin-aisle recovery led by Asia Pacific” concluded George. The region is vital for major long-haul markets and therefore demand for twin-aisles; if they rebound as expected the recovery in wide-body values will be significant.

Leasing growth is slowing as consolidation continues

In August 2020 the share of commercial passenger jets in operating leasing management exceeded 50% for the first time. The milestone represented a shift to leasing triggered by the Covid-19 shock, as debt-laden airlines turned to lessors as ‘financiers of only resort’ in Dick’s words.

In Rob’s view, talk of 60% market share is premature, pointing to low levels of trading between lessors and consolidation. Dick agreed with Rob’s assessment, arguing that while the role of the lessor will remain and maintain a majority share, 60% would likely be unachievable in the near and medium-term, noting the entrance of banks and growing numbers of alternative lenders, mostly private equity firms, acting to limit the lessor market share.

George noted that the growing market share of lessors as a tool for new aircraft financing can be a risk factor to lease rate recovery, with multiple lessors offering the same aircraft product to the same airlines. Will that competition pull down lease rates, even below the cost of capital? “If you look at the global picture, we’ve all just been talking about supply decreasing with not enough new aircraft being produced – all the macro factors suggest that lease rates should be trending up, but the question is who’s the lowest common denominator?”

In response, Dick Forsberg pointed to lessor consolidation, with high numbers of mergers and acquisitions completed and in progress, and the withdrawal of Chinese lessors from international markets. “I think you’re always going to get a group of lessors who have access to aggressively priced capital, and maybe there are some in the market today who are draining down their pools of liquidity raised before interest rates started to step up, using that to price some strategic deals aggressively” he explained. “I think as time passes those pools of discounted capital will be depleted and will be moving on to a more level playing field. There will be new entrants coming in, but also consolidation and pressure to price deals more appropriately going forward.”

Watch the webinar on-demand

To access the event recording, including the full panel’s discussion and debate, deeper analysis of retirement trends, and the panelists’ answers to our audience’s questions, watch the webinar on-demand.